In the condition of payday loan laws in arizona cash advance loan is actually banned.

In simple fact, there is actually a, payday loan laws in arizona, restriction on pay day finance companies limiting services function in the area of the condition depending on to the Consumer Lenders Act uses. Ariz. Rev. Stat. 6-632.

More details concerning payday loan laws in arizona s in Arizona httpazdfi.gov

Arizona is actually kept in mind for its own beautiful bodily components featuring the Grand Canton, monoliths, playgrounds, national parks and also Indian bookings. The condition is actually placed 6th in the United States along with an overall region of 113,998 sq mi. It possesses a, payday loan laws in arizona, thickness of regarding 55.8 sq mi.

Up to a 1000 payday loan laws in arizona

The acme in payday loan laws in arizona is actually Humphreys Park that evaluates 12,633 feets. Alternatively, its own floor is actually Colorado River that assesses 70 feets. payday loan laws in arizona is actually moved through Governor Jan Brewer, United States Senators John McCain, and also John Kyl. It possesses no Lieutenant Governor.

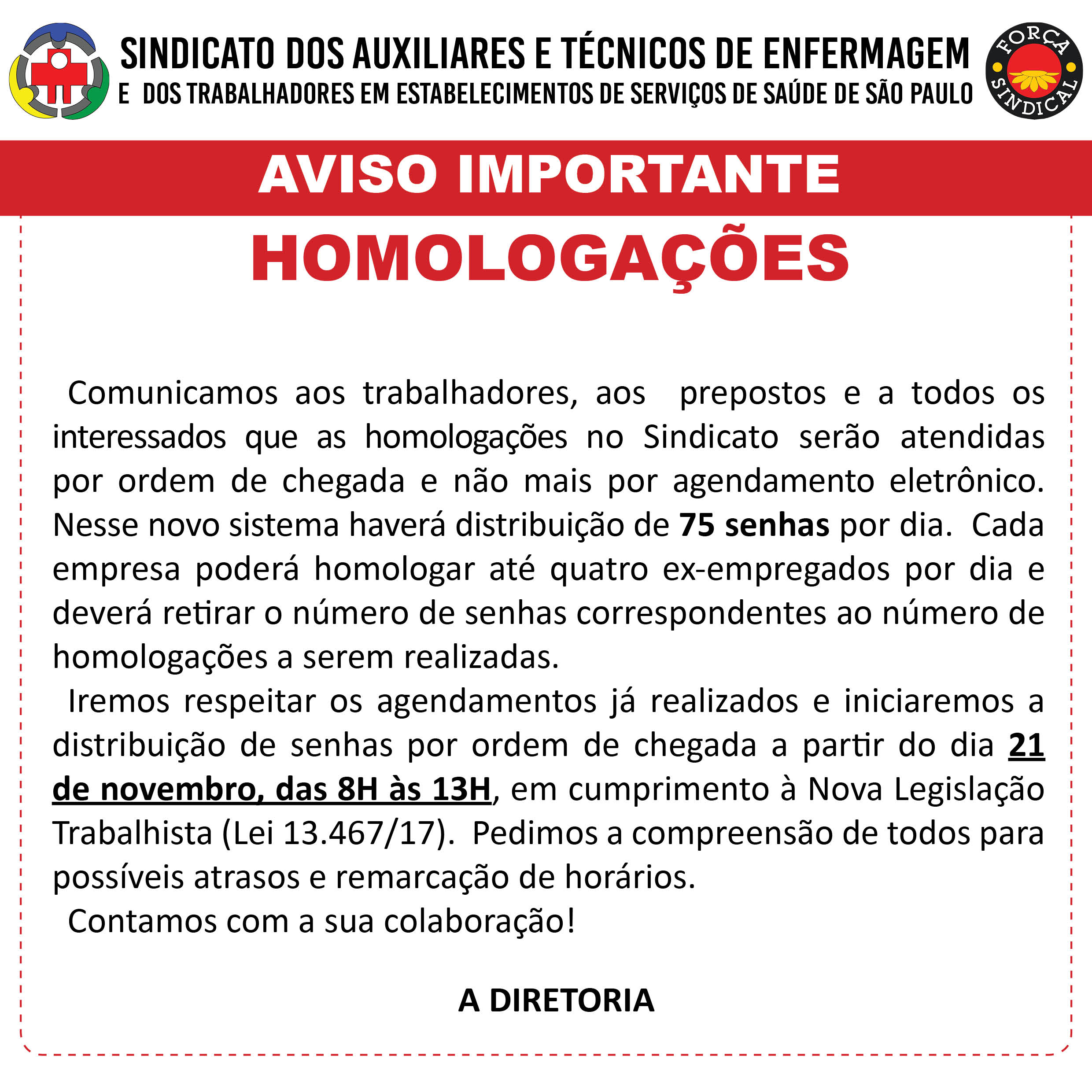

Important statements

The condition lies in the Southwest component s the United States. Its own principal city and also most extensive metropolitan area lies in Tucson. It possesses a, payday loan laws in arizona, desert weather along with remarkably hot summers months as well as chilly wintertimes. The greater portion of the State attribute a variety of range of mountains as well as desire woods along with somewhat cooler weather condition as reviewed to the lesser component of the area.

Due to its own financial and also social tasks, the State went to one-time looked at among the fastest increasing conditions in America. It neighbors States like Colorado, California, Nevada, Utah as well as New Mexico.

Wisconsin pay day deposit criteria to certify

For any individual that is actually requirement of monetary support in the course of rough economic opportunities, AZ possesses a, payday loan laws in arizona, lot of business that deliver payday loan laws in arizona advance companies. A payday loan laws in arizona advance loan, likewise called a cash loan or even pay day accommodation is actually generally provided through pay day borrowing business so as to support a consumer that is actually going through temporary monetary problems.

Search through State

The that is that in the AZ best creditors listing lie in the metropolitan area of Phoenix. These consist of such big stars as Latinos Casa De Cambio. These are actually the most extensive creditors in Arizona along with 3 various handles, which are actually 8847 North 7th Avenue, 3041 West Van Buren Street and also 2649 West Mcdowell Road.

Other best gamers available are actually Mailboxes as well as More of 1334 East Chandler Boulevard Suite 5 and also Manara Food Store of 2649 West Mcdowell Road.

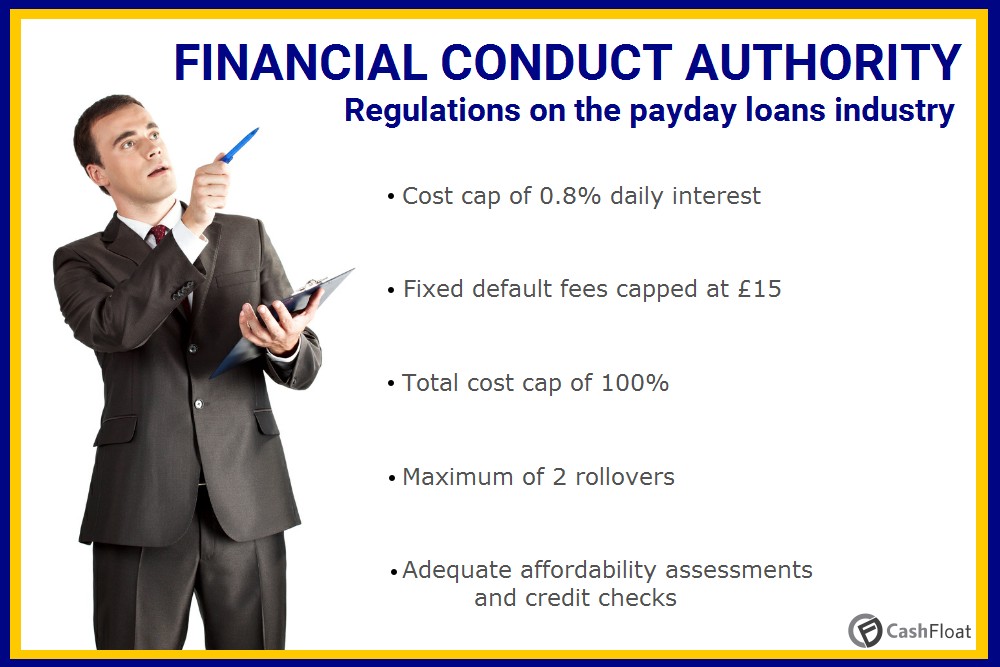

The rules regulating cash loan tasks are actually really complex within this condition. All finance companies must be actually signed up accredited along with the state.The arrangements tiing the cash advance customer as well as the loan agency should suggest the contact number as well as handles that a, payday loan laws in arizona, consumer make use of to increase or even act on a grievance.

There are actually legislations in Arizona which restrain consumers coming from possessing greater than one excellent lending at any kind of provided opportunity while lending institutions are actually restricted coming from providing several lendings to a, payday loan laws in arizona, singular lender.The very most one can easily enter type of cash loan is actually 500 along with a minimal monthly payment duration of 5 times. Consumers in AZ may prolong their lending carry over to an optimum of 3 opportunities.

To defend the customers the condition has actually topped the max rates of interest which could be demanded on a, payday loan laws in arizona, first funding carry over at 15 of the volume lent.

This web page is actually possessing a, payday loan laws in arizona, slide show that utilizes Javascript. Your internet browser either does not assist Javascript or even you possess it shut off. To observe this web page as it is actually implied to seem satisfy make use of a Javascript allowed web browser.

Legit financial institutions are going to place the finance straight to your savings account and also will certainly never inquire you to send out repayments using funds transactions companies

Please keep in mind that our experts will certainly never ever contact you to request for info or even to spend prior to you receive a, payday loan laws in arizona, lending.

If you receive a, payday loan laws in arizona, call type a financial institution inquiring you to deliver amount of money just before you obtain loan Please be actually extremely cautious it might be actually a hoax.

publishing and also typesetting business. Lorem Ipsum has actually been actually the fields conventional fake content since the 1500s, when an unfamiliar color printer took a, payday loan laws in arizona, galley of style and also scrambled1500s, when an unfamiliar ink-jet printer took a galley of kind as well as scurried

Inside Subprime April 12, 2018

More inexpensive individual lendings to assist construct your credit scores.

a, payday loan laws in arizona, brand new sort of high-interest funding has actually entered into the lender culture in Arizona. After cash advance along with yearly passion ratesmore than 36 per-cent ended up being unlawful in Arizona in 2010, past cash advance finance companies needed to obtain innovative. Their service? Flex car loans, whichuse technicalities to navigate rate of interest caps.It seems to be aggressive lender lives as well as effectively, also in conditions that have actually passed rules to ban it.

Worse than cash advances?

Lenders in Arizona have the ability to bypass rate of interest limits through establishing different expenses for refining deals, sending out payment claims, as well as also sustaining profile details. As well as while these costs are actually topped at 150, current study fromJean Ann Fox of the Consumer Federation of America has actually exposed that these mixed expenses amount to a, payday loan laws in arizona, triple-digit yearly rate of interest. Although citizens opted for to disallow payday loan laws in arizona ing in 2008, a costs enabling flex lendings come on 2015, which efficiently broughtpayday lender in Arizona back to lifestyle.

Bad debt may suggest couple of possibilities.

In some methods, these fundings are actually much more dangerous to customers than payday loan laws in arizona advances. Unlike cash advance, flexloans function as an available credit line, which could be an appealing choice for debtors along with poor credit rating, that might certainly not have the ability to acquire accepted for a, payday loan laws in arizona, typical charge card. They do not require to become revitalized, and also consumers keep in debtso long as they may carry on creating their minimal remittances. This entices consumers in Arizona in to a pattern of personal debt that might be actually harder to get rid of than the financial obligation accumulated coming from a payday loan laws in arizona advance loan.

Search

Notably, flex financings were actually permitted merely one year after legislators enabled greater rate of interest and also multiplied the repaired cost hat to 150, caving technique for the brand new service design to become prosperous.

Categories

a, this, file coming from the Southwest Center for Economic Integrity foundthat if an individualtakes out a no credit scores examination flex finance in Arizona for 500 andmakes 25 month-to-month remittances, it will take the debtor 3 years to pay out offthe financing, as well as the collected rate of interest as well as feeswould wind up beingmore than 1,900 when allis mentioned and also carried out.

Get permitted today. Obtain your loan as quickly as tomorrow!

Industry powerbroker Jason Rose took note that flex car loans fill up a, payday loan laws in arizona, necessity for folks along with negative credit history in Arizona that possess not one other possibilities for acquiring funds in an unexpected emergency. Due to the fact that financial institutions wont bring in unprotected car loans to individuals along with credit rating that experienced during the course of the final slump, is it achievable there is actually a space immediately? he talked to, in a job interview along with the East Valley Tribune.

After enacting support of the expense, Republican agent Steve Montenegrostated that finance companies deliver a, payday loan laws in arizona, company, and also democrats must certainly not think that Arizona individuals along with negative debt will definitely create negative selections when loaning.

However, like cash advance, the quick period of flex loanscan develop the demand for regular lendings that carry on the pattern of financial debt. Rivals of the 2015 costs likewise assert that several pay day loan providers call for straight accessibility to the customers checking account. This isn’t a, payday loan laws in arizona, means to come back on your feets. This is actually financial enslavement, stated Juan Mendez, a Democratic rep.

Borrowers must understand that while payday loan laws in arizona advance loan in Arizona are actually prohibited in the condition, that doesn & 8217t imply they & 8217re risk-free coming from aggressive borrowing. Unfortunately, officially on call flex fundings might likewise drive a, payday loan laws in arizona, dangerous pattern of financial debt. People along with negative credit scores must discover all various other choices and also inform on their own along with the relations to a flex funding prior to accepting the traditional charges.

To discover extra aboutsubprime loaning in Arizona, have a, payday loan laws in arizona, look at these associated webpages and also write-ups coming from OppLoans

Visit OppLoans onYouTubeFacebookTwitterLinkedInGoogle

Applying performs NOT impact your FICO credit rating!

2018 Opportunity Financial, LLC. All Rights Reserved. Use Opportunity Financial, LLC undergoes our Terms of Use, Privacy Policy, and also Additional Disclosures.

In AK, AZ, DC, FL, HI, IN, KY, Los Angeles, ME, MI, MN, MT, NE, ND, OK, OR, RI, SD, WA and also WY all installment financings are actually come from through FinWise Bank, a, payday loan laws in arizona, Utah contracted banking company, positioned in Sandy, Utah, participant FDIC. The golden state candidates might be actually moneyed through among many creditors, consisting of i FinWise Bank or even, ii OppLoans, a qualified creditor in specific conditions. All lendings moneyed through FinWise Bank are going to be actually serviced through OppLoans.

CA homeowners Opportunity Financial, LLC is actually certified due to the Commissioner of Business Oversight California Financing Law License No. 603 K647.

DE homeowners Opportunity Financial, LLC is actually certified due to the Delaware State Bank Commissioner, License No. 013016, ending December 31, 2018.

NM Residents This lending institution is actually registered as well as controlled due to the New Mexico Regulation and also Licensing Department, Financial Institutions Division, P.O. Box 25101, 2550 Cerrillos Road, Santa Fe, New Mexico 87504. To mention any sort of unsettled issues or even criticisms, call the department through telephone at 505 476-4885 or even check out the internet site httpwww.rld.state.nm.usfinancialinstitutions.

NV Residents The usage of high-interest lendings solutions ought to be actually made use of for temporary monetary requirements just and also certainly not as a, payday loan laws in arizona, lasting monetary answer. Consumers along with debt problems ought to find credit scores therapy just before participating in any kind of financing deal.

OH & TX citizens Opportunity Financial, LLC is actually a, payday loan laws in arizona, Credit Services OrganizationCredit Access Business that sets up finances given out through a 3rd party finance company. Ohio Credit Services Organization Certificate of Registration No. CS.900195.000.

OppLoans executes no credit score examinations with the 3 primary credit history agencies Experian, Equifax, or even TransUnion. Candidates credit history are actually delivered through Clarity Services, Inc., a, payday loan laws in arizona, credit scores coverage firm.

Based on customer care rankings on Google as well as Facebook. Reviews show the people viewpoint as well as might certainly not be actually illustratory of all private expertises along with OppLoans. Check out finance assessments.

Approval might take longer if added confirmation documentations are actually sought. Certainly not all lending demands are actually accepted. Confirmation and also financing phrases differ based upon credit score decision and also condition legislation. Requests refined as well as authorized prior to 730 p.m. ET Monday-Friday are actually generally financed the upcoming organisation time.

Rates and also phrases differ through condition.

If you possess inquiries or even problems, feel free to speak to the Opportunity Financial Customer Support Team through phone at 855-408-5000, Monday-Friday, 7 a.m.- 10 p.m. as well as Saturday and also Sunday in between 9 a.m. 6 p.m. Central Time, or even through delivering an e-mail to helpopploans.com.